🎢 #39 - How to make stock investing more fun and social? (Story of Public)

+ Karan Mehta (Investor at Octopus Ventures)

Hey there! Welcome to my email newsletter. My name is Leo Luo, a student entrepreneur at the University of Michigan. I write about founder stories, trends, investor POV, and unique behaviors in the early-stage consumer startup space.

All my previous posts can be found here.

Follow me on Twitter @_leoluo.

🍽 Today’s menu

Startup story -Public (Social investing app)

Investor POV - Karan Mehta (Investor at Octopus Ventures)

What I’ve been reading - 5 articles about startups and investing

Who’s ballin’ this week - 5 new fundraising/developments in B2C space

Jobs - 10 full-time jobs and internship postings

Feedback - help me to deliver better content to you

🔥 Startup Story

How to make stock investing more fun and social? (Story of Public)

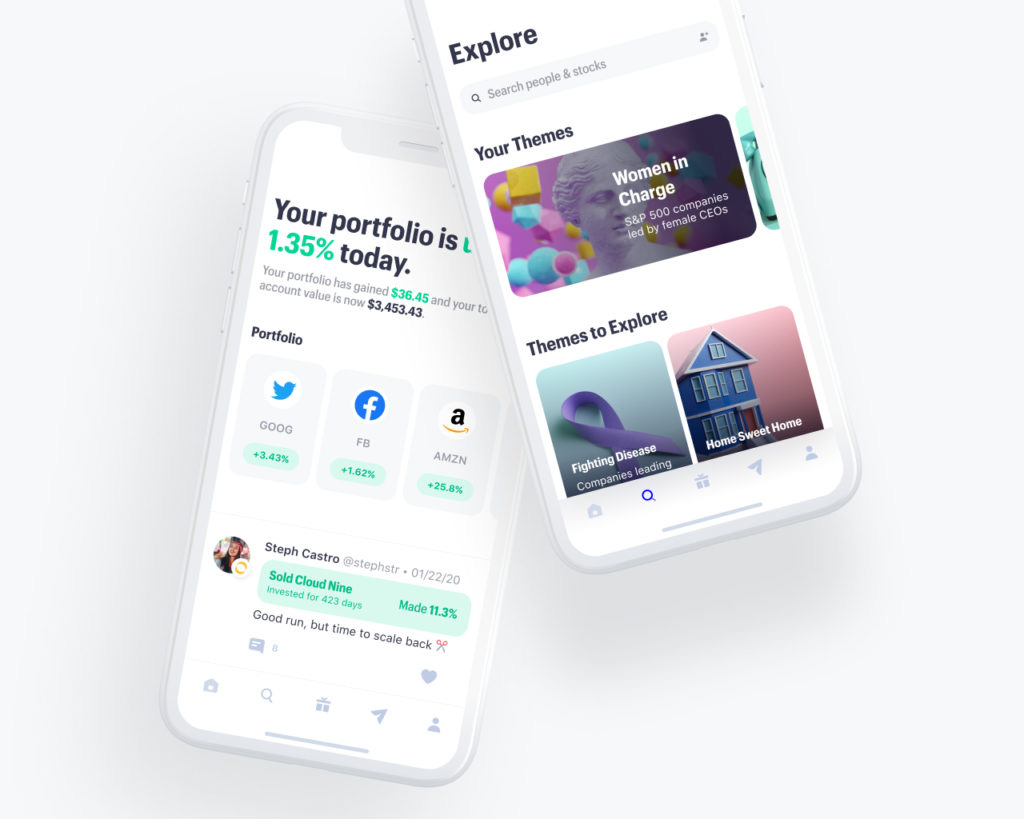

(Image credit: Public)

Stock investing can be intimidating. There can be a lot of friction involved in getting started, such as not knowing how stocks work or what stocks to invest. Robinhood made the experience more accessible for a large number of people, but a lot of barriers still remain for people looking to get started.

Public (backed by Accel and Greycroft) is addressing these barriers by making the stock market social. The platform allows users to follow other investors, discover companies to believe in, and invest with any amount of money. I had a fun time chatting with Jannick (Co-founder and Co-CEO of Public) about his learnings and the journey he undertook while building this fast-growing startup.

🌱 Jannick’s background and his connection to this problem

Jannick has worked in Fintech for the entirety of his career. He got his first job at Saxo Bank, one of the world’s first online banks for trading and investing. He would eventually leave to build four different Fintech startups doing everything from B2B credit facilitation to SMB SaaS.

Originally from Denmark, Jannick has always been fascinated by the US stock market and was surprised to find that many people did not take advantage of it.

“The stock market seems scary because I think all the communities that were built around the stock market have been white male-dominated. They talk about Wolf of Wall Street memes and have a very short term kind of focus. It starts to really resemble a culture more akin to gambling than any investing culture I’ve ever been a part of. We wanted to build Public because there was no community or product serving people who only wanted to be long term investors, build their financial literacy, and avoid getting into gambling habits.”

🚗 Product Journey

Initial Insight -

Jannick and his team’s initial intention was not to make a social app. Instead, their initial goal was to educate people at scale to reduce the intimidation many typically felt about stock investing.

“Most of the efforts I have seen so far for education have been people trying to sell a get-rich-quick scheme, or books that are too dense, in other words, designed specifically for power users. Thus, it really became a question of, ‘How do you scale education in a way where it hits every single user?’. That led us to the social layer, because we realized if we let people build a community that scales itself then it is education that scales itself, ” Jannick explained.

Beta -

The Beta product was a social feed of investments people made because Jannick and his team wanted to break the stigma that centered around money and get people in the habit of sharing investments.

“Whenever you make a trade on the app, you can post it and add a caption regarding the why behind that investment. Many communities built before us did not have a full-stack brokerage and social platform, which means that you could never really trust the information posted on that forum.

The first experiment was to validate if a full stack social and brokerage platform that could verify every single investment made on the app would lead to more constructive conversation. It worked really well.”

(Beta version of the app)

Fractional shares supercharging the flywheel -

During Beta, Jannick and his team noticed that a lot of people were interested in buying stocks that other people bought, but often couldn’t afford it due to the high price per share of the stock. They decided to change that.

“It was a good lesson for us. We had a decent flywheel with the social stuff. However, we realized that the way to supercharge that flywheel was not to make more details around the social feature itself but it was to change the underlying brokerage infrastructure.

Our growth went way up after launching fractional shares, at about 30% month over month. That was a fun lesson because we had to take a long path and work a long time to change the infrastructure, but it worked out for us.”

🤔 How Public acquired their early users

Interestingly enough, they didn’t go to communities where all the traders were hanging out, but instead took a more deliberate approach in search of more diverse communities. They would first identify underserved communities and then go after them.

“I think being very thoughtful about who you approach is really important in the Beta phase. For example, we wanted to get connected to professional women’s communities because we knew that historically women were not as invested in the stock market as men. This approach aligns well with our mission.”

😍 How to build a good culture

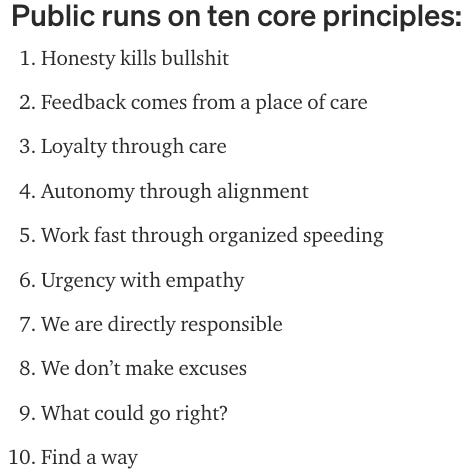

“One of the first things we did was to define a set of principles called Public OS. The thesis was that building a product, at the end of the day, is the sum of making millions of decisions over a period of time. I think you have to navigate that balance between opportunism and strategy. You want to have consistency and alignment across those decisions. It’s been a living, breathing document, and we have edited it over time. I think it has been super key to our ability to execute.”

(Public OS)

🚀 The Vision

“We want to make the stock market more inclusive, educational, and fun. Those are three words that we've picked very carefully. At the end of the day, they all go together. I think we are just scratching the surface of how we can do that.”

Check out Public!

💡 Investor POV

Karan Mehta (Investor at Octopus Ventures)

(Image credit: Karan Mehta)

Karan Mehta is an investor at Octopus Ventures, an NYC/London based venture capital firm that invests in Seed to Series B startups. Karan started his career in Sales & Trading at JP Morgan. He later worked on the family jewelry business where he led their digital transformation and started his own jewelry brand, which he exited in 2016.

He joined Octopus in 2018, focusing on investments across consumer tech and the future of work. I had a great time chatting with Karan about his journey to venture and his thoughts on the gaming space.

🔑 How Karan broke into VC

“I learned the true value of tech while helping my family’s jewelry manufacturing business with their digital transformation. They were writing invoices by hand and managing inventory on massive, color-coded spreadsheets. I decided to dive in head-first and digitized their entire operations from ERP to POS systems. I also managed to start an e-commerce brand that I was fortunate to scale and exit.

When I decided to pursue VC 4 years ago, I was like a bull seeing red. Pre-Octopus Ventures my network was nowhere near where it needed to be for a job in venture nor did I have the credibility. So, I created a new identity (ventureproject.co) and used it as my platform to engage and add value to founders, corporates, and VCs in the NYC ecosystem. I pounded the pavement, took a never-eat-alone approach, and essentially assumed the position of a VC (minus checkbook abilities). Over the course of 6 months, I accumulated a list of wins – i.e. meaningful intros for founders, VCs, LPs, and corporates - that helped establish a bit of credibility ultimately leading to my role at Octopus.”

🎮 Gaming trends that excite Karan the most

1. Rise of game creators tools

“I love looking at the creator space. Roblox is a huge UGC platform with 200m+ monthly active users. , Out of those MAUs, only 2% are creators. So what about the other 98%? What’s holding them back from creating??

Mutate is a cool startup that is not yet publicly available but one of the best I have seen so far in the game creation space. At a high level, Mutate is a web-based no-code game development platform where users can co-create and play multi-player games with their friends. Similar to how TikTok provides easy-to-use tools to create video content, Mutate does the same for video games and 3D virtual worlds.

Key to any creator tool’s success is that first experience with a platform – how quickly does the product deliver value? In terms of games - what is the time to fun? Also, what is the quality of the game and level of fidelity?”

2. Social elements of gaming

“One big thing in the gaming world right now is game clip sharing. There is a company called Medal TV and another called lowkey.gg. They make it super easy for gamers to cut up snippets of their gameplay and share them through all social channels. It’s a new way for folks to express themselves and also to remember gameplay highlights.”

👥 Most interesting founder he has met recently

“Abhi Kanakadandila is the most interesting founder I have recently met. He is the founder of D36, which is a music-centric identity brand for South Asians. He worked at SpaceX doing Finance for a few years and then led the strategy team at a music startup called Stem.

Here is the story of how we met:

I came across Abhi’s music and started following him on Instagram. I DM’d him after he released a song called Dallas Droptop and asked if he wanted to team up with Sofar Sounds (a portfolio company). We got to talking and he mentioned he was working on his own start-up called D36. We set-up a time to chat and within the first hour of speaking to him, I knew I wanted to back him. It was my first angel investment. Abhi is a brilliant, thoughtful guy with an eye for talent. I’m excited to see where he takes D36.”

📚 Karan’s favorite book

“The End of Karma by Somini Sengupta is a great book. It’s a collection of stories about modern India through the lens of young people. One of the stories discusses the caste system and how it will no longer exist in the next generation. Part of what is fueling this is access to the internet – companies like Jio have built affordable smartphones and now kids who are born into a certain life no longer take it for a given because they see what is possible beyond their communities. Their sense of purpose evolves.

The book reacquainted me with my roots and opened my eyes to the potential of founders in India and generally outside of Silicon Valley.”

👨💻 What I’ve been reading

I wasted $40K on a fantastic startup idea (good ideas don’t always mean good business)

A former point72 trader founded America’s leading nonalcoholic craft beer

The non-obvious guide to fundraising (NFX)

Working off-grid efficiently (software, hardware, internet, data storage)

9 tricks to experiment with your pricing strategy

🏀 Who’s ballin this week

Forbes launches massive expansion of paid newsletters

DuckDuckGo, a privacy-focused search engine, passed 100 million daily queries for the first time.

Curtsy, a clothing resale app aimed at Gen Z women, raises $11 million Series A

UK’s Bloom & Wild raises $102M to seed its flower delivery service across Europe

Wattpad, the storytelling platform that started as an e-reading app, is selling to South Korea’s Naver for $600 million

😍 Jobs & Internships

Full-time:

Apply - Headway - Product Manager (NYC or Remote)

Apply - Paliwoda - VC Analyst (NYC)

Apply - Unusual Ventures - Consumer Investor (SF)

Apply - X - Strategic Finance Project Lead (Mountain View)

Apply - AngelList - Venture Relations Associate (NYC)

Internships:

Apply - TCG - 2021 Summer Internship Program (Remote)

Apply - Cambly - Software Engineering Intern (Remote)

Apply - Mailchimp - Partnership Ops Intern (Atlanta)

Apply - DocuSign - Digital Growth Intern (SF)

Apply - Airtime - Community Development Intern (LA)

🙏 Feedback

If you have reached this far, could you please take 30 seconds to fill out this quick survey? It will help me to improve the newsletter and deliver you more interesting content in the future. Means a lot to me ♥️.

**P.S. I have adopted many of your suggestions in the past (e.g. having more bullet points, changing the order of the content, creating an archive for all previous posts, etc) so I hear you!

↺ What you might’ve missed in the last three weeks

01/17 - Story of GIST (social e-commerce app) + Steve Sloane (Partner at Menlo Ventures)

01/10 - Story of Shuffle (TikTok for podcasts) + Paul Strachman (Partner at Red Sea Ventures)

01/03 - Story of Run the World (Virtual event platform) + Rex Woodbury (Principal at Index Ventures)

Check out all the startups and investors I have featured in the past on this Notion board.