Hey there! Welcome to my email newsletter. My name is Leo Luo - I write about startup stories, consumer trends, and unique behaviors in the early-stage B2C space.

All my previous posts can be found here.

🔥 Startup Story

Sports cards, sports cars, and the story of Rally

(Image credit: Rally)

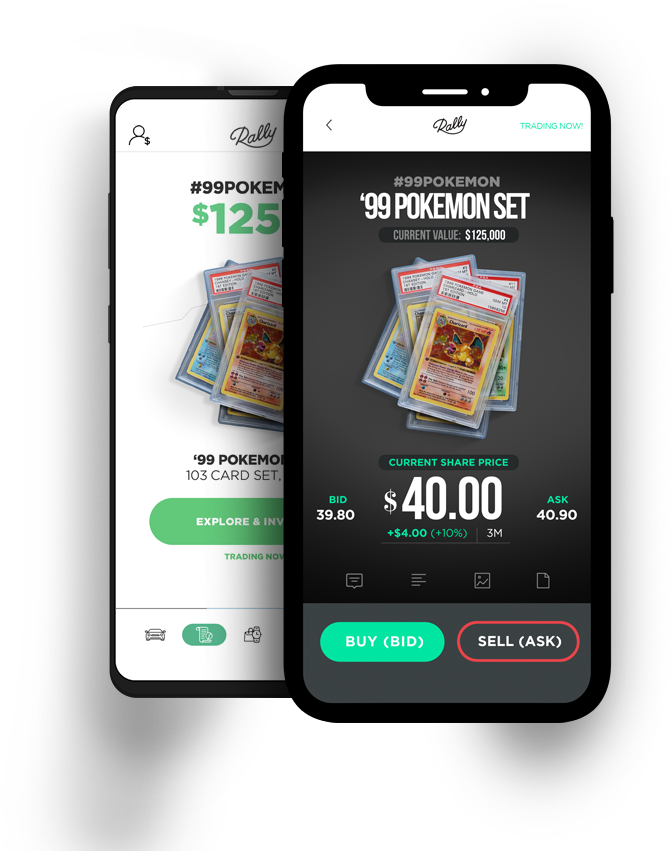

There have been numerous innovations in the investing world. One common goal is the democratization of investing. Public accomplishes this by making equity investing more social. Titan combines interesting educational content with passive investing. Rally is a rising startup that enables consumers to buy and sell equity shares in collectible assets such as sports cars and sports cards, helping people make money doing things that align with their passions.

I had a blast chatting with Chris, CEO and Founder of Rally, to learn more about their journey building a collectible marketplace.

🌱 Genesis

“This idea has been in the making for about 20 years. Back when I worked in VC, I observed what was happening in the early-stage investing space. 300 people controlled all the innovation capital - decision-making was very concentrated. It was very difficult for people, even for me who worked at a fund, to participate.

Then, Kickstarter came around and you could get financing from your early adopters. I was excited to see the rise of a new economy aimed at supporting people’s passions and helping people start companies they otherwise wouldn’t start. The next step was equity crowdfunding, which was meant to enable more people to own equity in a startup, rather than just supporting a project. However, I had never been more disappointed in my life - the first deals that I saw in equity crowdfunding were deals we had passed on six years earlier.

This sparked something in my head and I started talking to my co-founders, Rob and Max. We began to brainstorm solutions on how to democratize investing.”

💡 Unique Insight

“What are the differences between a venture deal and classic cars/sports cards?

The first is the level playing field in terms of information. I know as much about old Porsches as Jerry Seinfeld does, but he has a lot more money than I do. Hence, he’s the one who bought three cars and made $3M on them - I made none.

The second layer is enthusiasm. I am as emotionally connected to that asset class as other enthusiasts. This is rare, if not odd in finance, but not in passion areas. I could show up at a sports cards show and have a great conversation with someone next to me who owns the Honus Wagner baseball card.

The third is the expected return. Most funds shoot for 40% IRR per year but you are realistically aiming for 5% or 15% on classic cars and sports cards. You can’t put a 2/20 fund model on a 5% or 15% IRR.

The timing was right because of what was happening in crypto, where the fractionalization and digitalization of assets were getting popular. We decided to go all-in on solving accessibility and liquidity because if we couldn’t make the market fully liquid, we were not going to succeed.”

🚗 Product journey & solving chicken and egg

Chris and his team had a clear vision of what they were trying to build so the early days weren’t necessarily about validating the idea. There were four distinct challenges they had to solve - demand, supply, regulation, and experience. They had to tackle them all together to make this business work.

Getting things started (2017):

Supply - Like most marketplaces, Rally had to first curate the best initial supply. Chris and his team bought premium collectibles, such as baseball cards and classic cars, themselves.

Demand - To generate initial buzz and demand-side interest, Chris and his team went to the New York Auto Show and brought a cool classic car that would stand out amongst all the shiny stuff that was already there. They had conversations with 5k to 10k people in the course of a week. They were able to further refine how to communicate with people in a way that would resonate with them.

Regulation - They engaged regulators with the goal of creating a new asset class. They spent 9-12 months working with the SEC. It was challenging, to say the least.

“We were begging everybody to believe us. It was incredibly hard when we saw other people saying, ‘if regulation isn't for us, we're just going to offshore it, or call it a currency, not a security, and just do it anyway’.

That isn’t our philosophy - we want to build a financial market that lives alongside the biggest commodities, equities, and other existing markets. To do that, we have to be respected by regulators, so that we in turn gain the confidence of retail investors. Once they participate, the next step is to create a space where institutional investors feel comfortable participating.

(Their car at the NY Auto Show - 1969 Ford Mustang Boss 302)

Rally MVP (Post SEC Approval):

Chris and his team decided to go back to NYC and rent a showroom for three classic cars, while opening up their first investment. Not only did it attract attention from potential customers, but it also garnered interest from investors.

“We rented a showroom on Wooster Street - it was like one of those old gallery spaces, but it had a garage door in the front. We wheeled in a couple of our assets and opened up our first investments at that point in time. We met with Jeff from Acorns and Eli from Betterment, who became investors in the company because they were walking down the block and got interested after seeing the showroom. It helped us build community in an authentic way.”

The most traction from the showroom came from media attention. They were featured on CNBC, WSJ, Bloomberg, and many other media outlets which helped them to get a ton of organic demand.

(Bloomberg article on Rally)

Traction and growth:

Rally now has hundreds of thousands of users and tens of millions in assets under management. However, this success did not come overnight.

“We are building a financial system and you don’t build it overnight. You have to spend time working with regulators, curating supply, attracting demand, and creating a good product experience.”

🤔 Challenges

Raising money around the concept

“We were getting a lot of high-fives because everyone loved the concept and we had enough traction, but it was hard to get investments. What helped us was the authenticity of the story we were telling. My co-founders and I were all-in on Rally and we had more to lose than other people going into this. Also, we were very fortunate early on to find people who believed in us for the right reasons. Our investors wrote us checks because they genuinely cared and believed this platform should exist.”

The complexity of creating a new category

“We had to solve many problems across so many dimensions, at the same time, and also in an aligned way. None of them was particularly worse than others - they were all challenging. For example, when we first told our lawyer about what we were trying to do, they told us ‘no, that’s impossible’. We had to convince them since it had never been done before and there was no playbook.”

🚀 Vision

“Our vision is to democratize investing in collectible assets and become another category-defining company, alongside companies like NASDAQ and Coinbase.”

Check out Rally!!

👨💻 What I’ve been reading

How Zapier reached a $5M startup valuation without jumping on the VC ‘Hamster Wheel’ (I am interning there, amazing firm!)

Nik Sharma shared some insights on how to build a DTC brand in 2021, from building an audience to retention.

This article discusses foodtech, specifically where you should start a foodtech startup and what factors you should consider.

Packy talked about the founding story of MainStreet and announced its $60M Series A

😍 Jobs & Internships

Full-time:

Weekend Fund - Founding Product Designer (N/A)

StockX - Financial Analyst (Detroit)

Prose - Product Analyst (NYC)

Helen of Troy - Associate Product Manager (NYC)

Paradox - Associate Product Manager (Scottsdale)

Internship:

Cambridge Associates - VC Intern (Boston)

Upwork - Product Manager Intern (Remote)

Lunchclub - Software Engineer Intern (Remote)

Silicon Valley Bank - SVB Capital Intern (Menlo Park)

Box - Education Intern (Remote)

🙏 Feedback

If you have reached this far, could you please take 30 seconds to fill out this quick survey? It will help me to improve the newsletter and deliver you more interesting content in the future. Means a lot to me ♥️.