Hi Friends! Welcome to the Consumer Startups community where we share stories about early-stage B2C startups and insights from the best consumer investors. All my previous posts can be found here.

If you aren’t subscribed yet, join a group of builders, founders, investors by subscribing here:

🔥 Startup Story

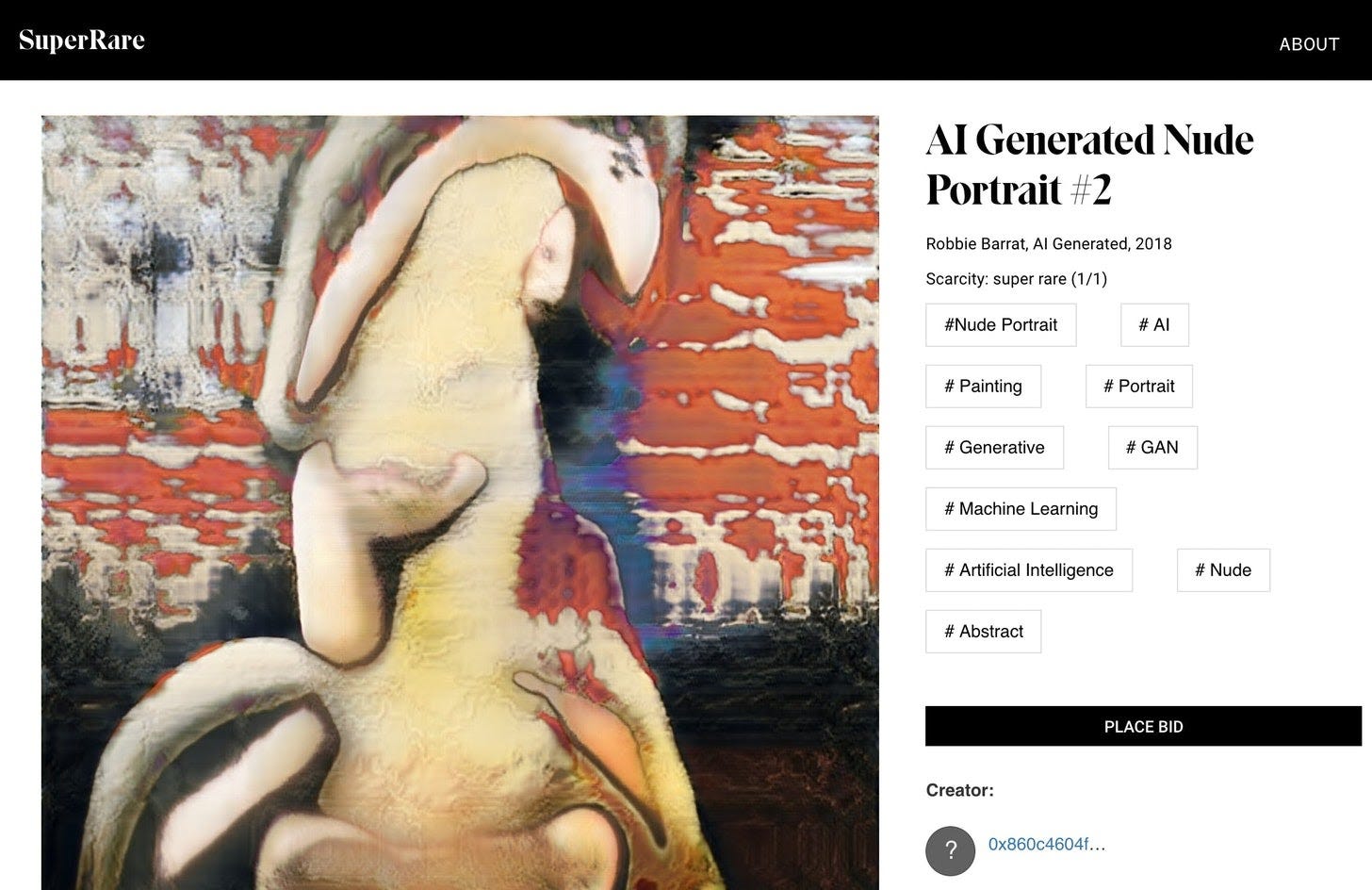

NFTs, SuperRare, and the business of digital arts

(Image credit: SuperRare)

In just the first quarter of this year alone, total NFTs sales have jumped to more than $2B. The most well-known NFT artist, Beeple, sold his digital art Everydays: The First 5000 days for $69M. I’ve witnessed this hype first-hand as my moments on NBA Topshot doubled in value just a few weeks ago.

I reached out to John Crain, the founder of SuperRare, to learn more about this space and what it takes to build an NFT startup. A $9 million Series A after a huge surge in traction during COVID has cemented SuperRare as one of the leading NFT startups for digital arts.

🌱Genesis

John’s interest in digital art goes back to his earliest years. His passion for creative crafts led him to a career in advertising in NYC primarily focused on creative technologies.

“I was always a big doodler. Someone showed me that I could create art with code. I was fascinated by the fact that you could generate 1000 circles in one second. I ended up moving to New York to take a job in advertising, pitching and implementing creative ideas for technologies like Arduino and Xbox Connect.”

While working in New York, John developed an interest in crypto and decided to join ConsenSys as a product engineer. It was during that time that he first came into contact with NFTs after coming across NFT startup, Dapper Labs.

“Before SuperRare, it was hard for digital artists to monetize directly from their artworks. People were dropshipping t-shirts with prints or selling cell phone covers. I felt like there would be a large digital art market because we started seeing bargains move from analog to digital. When NFTs launched, I realized that they were the final piece of infrastructure needed to facilitate a large digital art market. That’s when I decided to start building SuperRare.”

🚗 Product Journey

Initial validation and unique insight:

There were a few signals that helped the team gather additional conviction in their idea.

First, people were selling digital art in the contemporary art market, though digital art made up a small subset of total sales. Second, there had been previous attempts at building a product around digital art (Counterparty for example) and murmurs of a new digital art marketplace. However, they all lacked an important element - fun.

“Collecting art should be fun. Nobody had built something that accentuated the fun element. The fun in art for me is connecting with artists and talking to other people that are interested in art, so I felt that it was important to have a real market in the center, but a social platform as well,” John explained.

MVP (2017):

John and his team spent six months prototyping and building a platform that they would want to use after cementing their idea. The end product was a functional MVP with three main components - NFT minting software, a marketplace, and a secondary resale marketplace. They had one launch customer at the time.

“We had one collector we knew personally who wanted to buy a piece of art. We facilitated that transaction through our platform. Afterwards, we manually reached out to artists and collectors to get people to come try out the platform.”

In the first year, they had 100 artists and 200 collectors on the platform with $90k in gross volume.

(Image credit: SuperRare’s early product)

Catalyst (2019):

Two years into the project, SuperRare started to see growth as collectors began to build virtual exhibition spaces for their art collections behind the launches of VR platforms such as Decentraland and Cryptovoxels. This change in consumer behavior spurred the growth of SuperRare’s platform to over 300 artists and 500 collectors in 2019 and $250K in gross volume. Nevertheless, the scale was still too small. John and his team had to do consulting and other jobs to pay the bills.

COVID Changed the Game (2020):

The pandemic changed a lot of things in the art market - art galleries, museums, and in-person art events were on pause.

“There had been a lot of discussions in art around digitalization. People began building online viewing rooms and auctions almost immediately. We were in a fortunate position since we had already been doing both of those things. As it snowballed, more and more artists and collectors began to give credence to NFTs as a medium for art, so people from the art world started to take us more seriously.”

This transition in the art world also coincided with a massive bull run in the crypto market which propelled SuperRare to exponential growth.

“In the first year, we did $90K in gross volume. Now, we have over $30M in gross volume in March alone with over 5000 active collectors and 1500 active artists on the platform.” 🤯🤯

🤔 Challenge they faced

Raising money was hard in the early days

“Raising money was incredibly hard in the early days since everyone thought it was a terrible idea. I think that there will be a lot of uphill battles if you are truly early in a market, or if you are building something really new. It’s helpful to make a directional bet and then keep pursuing if you have a lot of conviction. It takes a long time to build something of lasting value.”

😍 Advice for starting a NFT company

Pick a specific industry vertical and focus on building a good product experience

“NFT is just like a technology standard. It is a way to uniquely identify a digital object. It can be valuable for many areas that require this functionality, like building interoperability for items in the metaverse.

The technology itself is very simple and straightforward, and you can apply it to specific use cases. The key is to pick an industry vertical and build a great product experience around it. For example, you could build a marketplace for virtual land in the metaverse with a Zillow-style interface.

Even though the technology layer is similar, the challenge is building a good product experience around a specific vertical.”

🚀 Vision

“We want to build an entire ecosystem for digital art. It’s still super early, even for things as simple as home display. We want to build the best tools to support this market, such as creating an ecosystem around display, and making developer APIs to enable other people to use their own creativity to build products that we can’t even think of.”

Check out SuperRare!!

Please please share this newsletter with your friends if you liked this story. It takes me quite some time to write content like this so I would love to reach as many people as possible.👨💻 What I’ve been reading

Coinbase’s story from YC to IPO and their original pitch deck

Jay from Maven Ventures wrote about the evolution of retail investing and the future of consumer investing platforms (Hint - social, mobile-first, have a nearly non-existent barrier to investing, and are increasingly passion-driven)

Interesting story and lessons from a grueling two years selling a media startup, The Tab

How Tiger Global is deploying low-cost and low-touch capital to take over the growth investing space.

Great post on Secfi and how to approach exercising startup options, which can be insanely expensive

😍 Jobs & Internships

Full-time:

Outer - Product Manager (Remote/Santa Monica)

NextView - VC Associate (NYC)

Exer Labs - UI/UX Designer (Remote)

Clubhouse - Biz Ops (SF/Remote)

Italic - Chief of Staff (LA)

B Capital Group - Pre-MBA Associate (LA)

Internship:

Toyota AI Ventures - VC Intern (Los Altos)

Playground Global - VC Intern (Remote)

Jemi - Marketing Intern (Remote)

Gametime - Corporate Strategy Intern (NYC)

SigFig - Strategic Partnerships Intern (Remote)

ThredUP - Data Engineering Intern (Remote)

**Big shout out to my friend Kelvin Boateng who has been helping me with this newsletter in the past few months! I appreciate you, Kelvin!