Hey hey 👋,

Welcome back!

Two weeks ago, I featured Fractional, a platform that democratizes real estate investing. It allows people to co-own investment properties with their friends through fractional ownership. After publishing that piece, I decided to dig further to look for other innovative companies in the real estate space.

Specifically, I wanted to learn more about the other side of the coin - homeownership. Investing for upside is great but most consumers are more concerned about owning a house to live in. It is often the biggest and the most stressful purchase of one’s life. Most people don’t understand the different moving pieces that go into buying a house (myself included before writing this piece).

One startup I came across is Quo - it aspires to be your GPS to homeownership. I had a chance to chat with the CEO & Co-founder of Quo, Tucker Haas, to get a glimpse of his vision for the future of homeownership and how Quo will play a part in that future (shout out to my friend Ruffini for the intro).

Oh.. by the way, feel free to check out this Notion board if you are interested in learning more about some other startups I have featured in the past.

First, let’s do a quick rewind to learn more about Tucker’s background 📼…

From Runescape bot to ultrasound software

Tucker started programming at eight years old due to a video game, RuneScape. He wanted to create bots to level up RuneScape accounts quickly and sell those accounts to make money. It was a great business before he was banned from the game, netting him thousands of dollars 💸.

To avoid more trouble, he went on to build seven different applications (mostly mobile) for local businesses in Charlotte, anything from creating a device that could project images onto granite tombstones to building a calculator tool for golf courses.

His entrepreneurial odyssey continued when he went to study computer science at Stanford. Similar to many other Stanford student entrepreneurs, his first attempt was to build a social networking company as a way to meet new people (shout out to all my college friends who worked on social apps). He then took the learnings and built a somewhat successful product in the 3D ultrasound space, even licensing the technology to companies.

Despite some initial success, it didn’t last. As Tucker was winding down the company, he met his now Quo co-founder Neel, a Stanford graduate that was working at the biggest Neo-bank in Germany called N26.

Genesis of Quo

Another part of Tucker’s story is that he comes from a lower-middle-class family that struggled with their fair share of economic hardship. His younger sister was born with Kernicterus, a rare form of preventable brain damage. The treatment was expensive, which led to a large amount of medical debt. In addition to that, his father’s business was also struggling. These two financial emergencies combined drove Tucker’s parents to file for bankruptcy.

“Eventually, my parents were able to recover, but they found themselves haunted by the impact of this period. One of the worst effects was the damage it did to their credit. These financial emergencies made it nearly impossible for them to get any credit even after their income and debt repayment were back on track. Even today, almost 15 years later, they still have trouble getting a loan." - Tucker

As Neel and Tucker started to brainstorm some startup ideas, fintech became the natural first thought due to Tucker’s personal relationship with problems in the financial space and Neel’s work experience at N26.

They aligned on the mission to create a product that can level the financial playing field. They then narrowed down on homeownership due to its role in impacting generational wealth for people. It was also clear to them that despite all the innovations so far, this space is still problematic.

Two key issues:

It is difficult for people to know what to do to buy a house due to a plethora of either false or generic information

For example, many people think they can’t get a house because of their student loan (which is not true)

Most companies in the space focus on the moment when someone is ready to buy a house while the home-buying process takes a long time for most consumers

Wedge strategy and full-stack platform

First step - initial wedge (September 2020)

It is often hard to get initial traction in the early days. It is especially challenging for consumer finance because it is dealing with people’s hard-earned money. One way for a startup to tackle this issue is by picking a wedge. Lenny summarized this concept perfectly in his most recent newsletter:

“A wedge is simply a strategy to win a large market by initially capturing (1) a tiny part of a larger market or (2) a large part of a small adjacent market.

Twilio started with an API to send SMSs and is now the de facto communication API platform, worth over $60B. Airbnb started out allowing people to rent their extra rooms and now accounts for a fifth of the $90B vacation rental market. Amazon started out selling books and now represents about 40% of all U.S. e-commerce.” - Lenny

Initially, Quo also pursued this wedge strategy by focusing on offering a small-dollar loan. Most traditional institutions charge an exorbitant rate for small-dollar loans/payday loans, which often worsens a consumer’s financial situation. Tucker and his Quo team wanted to reinvent a new model that would allow a consumer to get access to a low-interest rate, increase savings, and build credit. Check out this article if you are interested in learning more about how this small-dollar loan product worked.

It worked well from the demand side. Their strong value proposition quickly enticed over 40K people to sign up on the waitlist. They were also seeing strong retention and engagement from the users. However, despite seeing strong demand, they decided to make a pivot due to two main reasons:

They were seeing many delinquencies on the platform (likely due to the nature of the product and the type of customers it was attracting).

It was not enough to just build one piece of the puzzle if they wanted to help people to buy a home.

“When you only focus on credit, you are able to help people but you're not able to orient around this larger goal of buying a house. To have that full picture, you need to know their income, their assets, their debt, and credit. A lot of current solutions are only focusing on one part of the puzzle and they ignore the interplay between all of these factors. For example, my credit score influences how I should think about my income, which also influences how I should think about debt.” - Tucker

At the beginning of this year, the Quo team shifted its approach to build a full-stack solution that can take into account all the factors that affect homeownership.

Second step - full-stack platform (early 2021)

After making the decision to make the pivot, the Quo team immediately got to work. The first step was to break down the different pieces that they had to connect together in this new full-stack offering.

From the consumer’s point of view, there are four pillars for buying a house:

Credit history - crucial for getting a good mortgage rate

Income - income level determines how much you can pay on

Assets - savings and assets that can be contributed to the home purchase

Time horizon - the amount of time it takes to save up for the home purchase

These four pillars informed many of the product decisions at Quo.

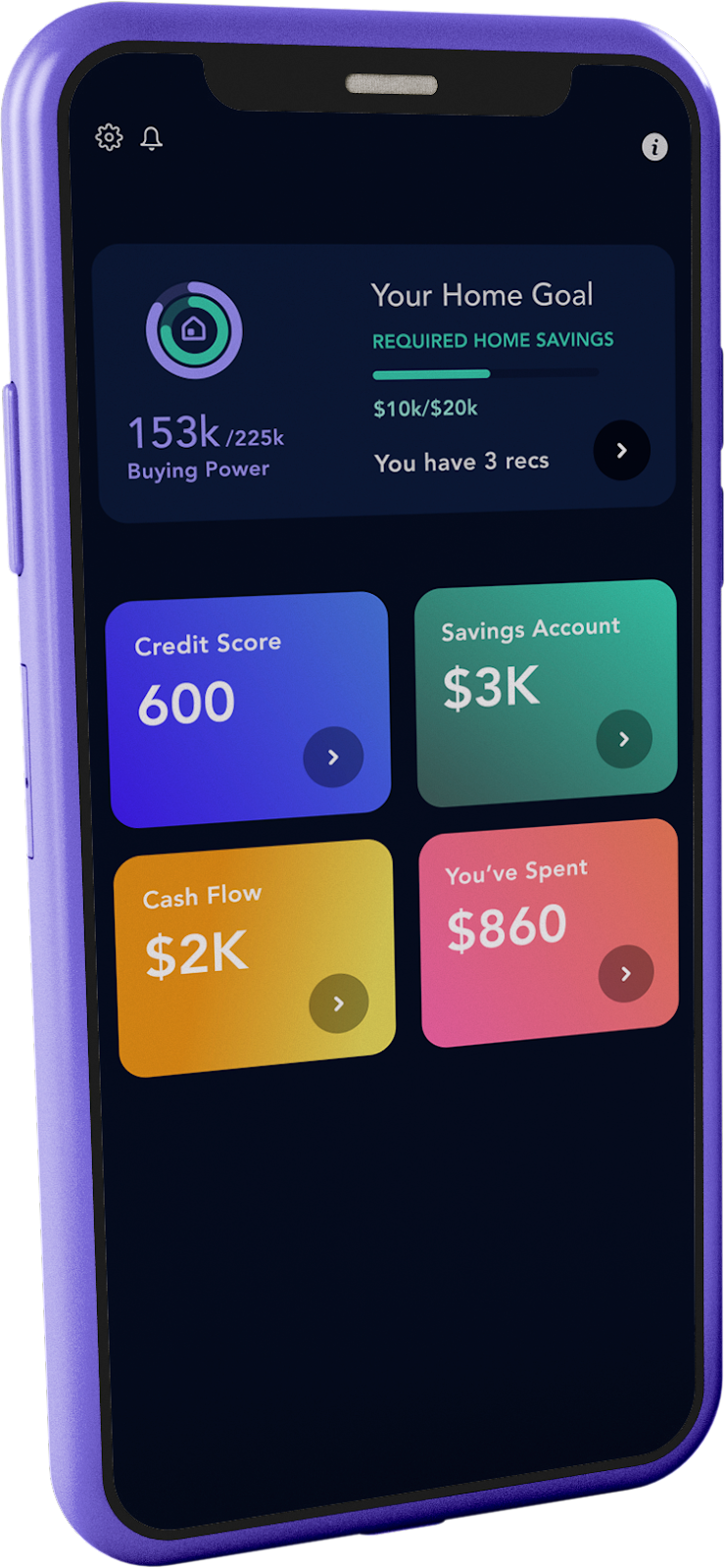

The first part is education. Quo helps consumers to track their home purchase progress via an intuitive dashboard, detailing their credit score, savings, asset, and the time horizon for buying the dream home. Not only do they inform consumers of their progress, but Quo also provides them with actional advice based on those numbers. For example, the platform will recommend which debt to pay off first based on each consumer’s unique situation.

The final piece of the puzzle is buying a house. Once the consumer is ready to house hunt, Quo can instantly connect them with their in-house mortgage brokerage platform (they recently acquired a brokerage company to do this) and a personal mortgage coach to get them through the finish line.

Future of homeownership

Quo has an interesting model that is vastly different from the existing players. It verticalizes the entire experience from education to home mortgages, making the process seamless for consumers. It makes money by charging a $7.99/month subscription fee and also 1-2% of the loan if the user ends up getting a mortgage via the platform (loan gets preapproved 3X faster on the platform due to Quo’s pre-existing knowledge of the consumer).

So far, the model has worked well. One of the KPIs they track closely is how much are people saving towards a home purchase - they just hit $18M in total savings, an 18x increase since July.

Quo’s vision

“Within homeownership, I see the opportunity for us to radically change how people buy houses. The way that people buy homes right now is broken. It's so focused on this humongous transaction and there's little attention put on that journey ahead of time. When you shift your framing to how can I help somebody go from zero all the way to buying a house, you can make the process a lot more efficient. You can do things like understanding what somebody wants in a house and helping them find it over a longer period of time. And that's how you can start to disintermediate players like realtors who you know are taking as much as 3% of that house as commission.

Over the long scale, we see the opportunity to use the same building blocks to go after other financial goals. For example, buying a car is really similar to buying a house. It's just less intense. You still save money, you still need to work on your credit, you still need to work on your debt so all the tools we're building around budgeting and saving and credit-building are applicable within all these other areas. First, you buy a car with Quo, then you buy a house, maybe then you're planning for retirement. It will become a lifelong membership.” - Tucker

That’s it for today. See you next Sunday 👋!

Leo