🍬 The future of CPG wholesale marketplaces

+ Pain points, trends, current players and many more!

Hey hey 👋,

Welcome back to Consumer Startups!

Typically, I focus on B2C-focused verticals such as consumer social or consumer fintech; however, today’s piece is a bit different. I am writing about the fascinating world of CPG wholesale marketplaces. It is a space I am following very closely since I work at a marketplace/e-commerce startup. It is not exactly in the B2C realm (more like B2B2C), but it is an industry I am very bullish on and has a ton of opportunities.

For those who want to just get the main insights, here are some quick takeaways:

The wholesale market is massive - there are many opportunities to help small retailers to acquire products more efficiently since many current solutions are either inefficient or are not designed for small businesses.

Small retailers in the CPG space need a ton of help procuring products so that they can have a better chance of competing with companies like Walmart.

Four main pain points for small retailers related to procurement - difficulty working with distributors, inefficient payment process, communication with vendors, and new product discovery and testing.

Two industry trends - the rise of highly verticalized marketplaces and the rise of premium services

Bonus content - continue reading to find out!

If you have not yet subscribed to this newsletter, make sure to do so below so you don’t miss out on future deep dives.

We are spoiled as consumers in 2021. There are so many innovations happening in the B2C world and they have forever changed how we live our lives today.

You can accomplish most of your goals with just a few taps. If you want food delivered to your door, you can open Uber Eats and order from 100+ restaurants in the region; If you need some last-minute grocery items, such as pasta and eggs, you can use an instant grocery delivery app like Jokr, which can deliver your items within 15 mins; if you are looking for a spontaneous trip abroad, you can use Airbnb to book some lodgings at an affordable price and live like a local. Everything is so convenient these days that I can barely remember what it was like before those apps existed.

Despite all the digital disruptions happening on the consumer front, the B2B side is still very much in old age. This is especially true for small retailers and their supply chain.

Many small retailers rely on phone, email, and pen and paper to source and purchase their products and services; There is not an easy or centralized platform for them to buy products like how Amazon is for consumers. Most rely on distributors to source products or buy directly from brands. Depending on the industry, they might find those distributors and brands by:

Attending trade shows

Reading industry trade publications

Find online catalogs

Googling and cold calling

Buying from another local store

Networking with peers (both online and offline)

This is a massive space that affects many people. In the US alone, there are close to 30M small retailers, and the entire wholesale market is close to $10T. Those small businesses are the backbone of this economy. Nearly half of the US workers are employed by small businesses, and small retailers with 50 or fewer employees make up 98.6% of all retail firms.

Wholesale marketplace and why now

One way to digitize the product procurement process for small retailers is to create a wholesale marketplace that facilitates B2B transactions (especially for products that are relatively standard like toilet paper and chips) by connecting retailers, distributors, and manufacturers.

This is not really a novel concept by any means. Wholesale marketplaces have been around since before the 2010s and even prior to the 2000s. Many companies such as Ariba (acquired by SAP) and Coupa have done pretty well so far offering “e-procurement” services.

So... if those wholesale marketplaces have always existed, why are we talking about this topic now?

Bessemer has a great report called Roadmap: B2B marketplaces, which talks about the shortcomings of those legacy wholesale marketplaces and the ‘why now’:

1. They are mostly horizontal platforms

Mostly built for enterprise procurement department, not for small businesses

2. They are expensive and hard-to-use

High fees, lengthy setups - again, not friendly for small businesses

3. They lack integrated payments and lending

The payment process takes a long time

4. They do little to facilitate trust

Mostly focused on digitizing existing buyer/seller relationships vs facilitating new connections

In plain words, those 1.0 marketplaces suck, and they are not meant for mom and pop shops. In addition, people (especially Millennials who are starting many small businesses) are so used to beautifully designed consumer apps that they hate clunky legacy platforms that are expensive and hard to use. With the rise of API tools and the decreasing software development cost, it is becoming a lot easier for anyone to build a beautiful B2B wholesale marketplace. I can probably use a combination of different no-code solutions like Webflow, Stripe, and Zapier to hack together a marketplace MVP to quickly validate my idea.

Many founders have realized this market opportunity - the entire space is exploding.

CPG wholesale

One of the biggest segments of the wholesale marketplace industry is CPG wholesale. Consumer Packaged Goods (CPG) are products that consumers use almost daily and restock frequently, like food, beverages, toiletries, and cleaning products. In 2019, CPG is said to be about $815B in the US, which would account for 3.8% of the total US GDP of $21.5T.

Despite the massive market potential, this is a tough industry for small retailers because they are getting squeezed by big players on both sides of the market. On the demand side, most consumer demand is captured by behemoths like Walmart, Kroger, and Costco, while the supply side is also highly dominated by CPG conglomerates such as Pepsi, Nestle, and Mondelez.

In the grocery space (one of the biggest sectors of the CPG world), only about 21% of grocery dollars go to indie grocers, according to a 2018 Nielsen survey. It’s also not a surprise that the market condition has further exacerbated during this global pandemic as companies like Walmart continue to command market power and get the first dips on best-performing products at a more favorable price than small grocers.

One of the ways to compete with industry behemoths is to digitalize the business and adapt to the changing consumer behaviors. There have been many innovations happening already. One example I have seen recently is online delivery. Mercato is an online marketplace that connects consumers with local grocery stores. It helps shoppers get the convenience of Instacart while supporting local businesses.

I think another big opportunity lies in the procurement process for small retailers. This is where CPG wholesale marketplace comes into play.

I believe that the next generation of CPG wholesale marketplaces has the opportunity to help small retailers to a) lower operating expenses by improving the efficiency of the procurement process and b) stay more agile on the inventory stocking process to meet the changing taste of consumers.

To gain a deeper understanding, I read some trade publications and spoke with my friend Laura who ran a bakery in North Carolina and has advised many small businesses to learn more about different pain points in the space.

Problems in the space

1. It is hard to work with distributors for small retailers

Retailers heavily rely on distributors. However, it is hard to even get on those distributor networks if you are small. Laura took three tries to even get on the radar of distributors when she first started her small business.

“It took me three attempts reaching out to distributors to get a representative assigned to me. The whole process was long. They usually only show you the catalog, not the prices so I had to go through the quotation process and wait for them to get back to me.” - Laura

2. Payment processing is inefficient

The payment process in the space is very loose. It varies based on the distributors or brands. Some companies have an online portal that buyers could use to place orders, but for most companies, transactions happen offline.

“Every week, I would set up an order, email distributors to place the order. There was no set process, and I definitely spent way too much time placing the order for the week” - Laura

3. Communication with suppliers can be challenging and frustrating

Working with multiple distributors and brands is difficult for a mom-and-pop shop that only has limited time and resources, specifically around communication. Sometimes, suppliers wouldn’t notify shipment delays or order changes, making it very stressful for the small business owner.

4. Discovering and testing new products

Unlike large buyers like Walmart that have the resources and time to find new products, small businesses have a difficult time keeping up with all the emerging trends in the space and getting access to different brands. The value is immense if there is a platform that can help them to get access to different brands and test out new products in a risk-free environment (low minimum order quantity & friendly return policy).

There are way more problems in this space than those four above. However, these are the ones that I found to be the most salient.

Solution - CPG Wholesale Marketplace

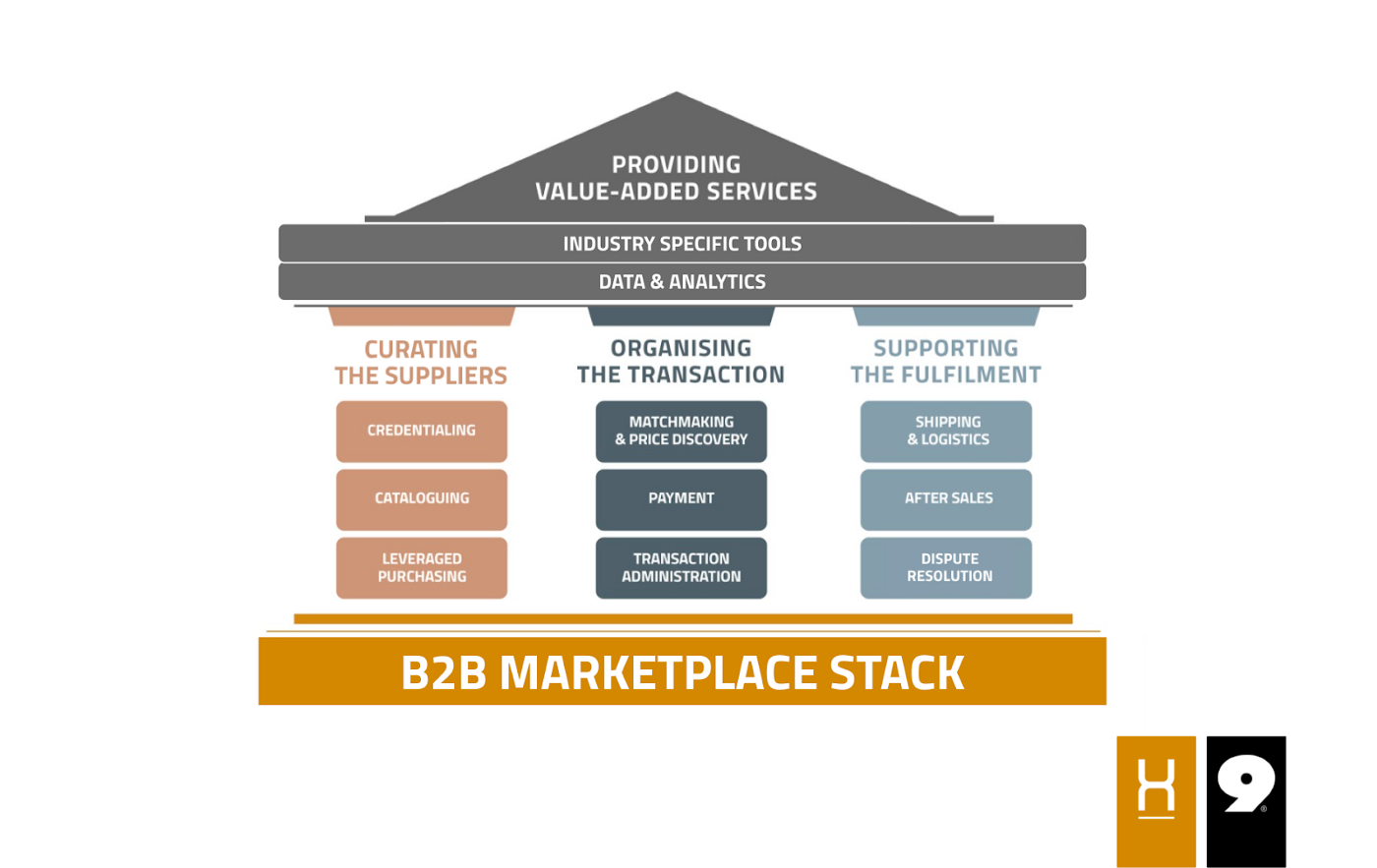

Julia Morrongiello from Point Nine (B2B marketplace focused VC) wrote an amazing article on the B2B Marketplace Stack. She breaks down the functions of the B2B marketplace into four distinct parts:

This is a great framework to think about how a CPG wholesale marketplace could solve those four pain points I listed in the previous section.

1. Curating the suppliers

This function solves pain points #1 and #4. The wholesale marketplace democratizes access to different brands for small retailers. By curating the best brands and lowering the minimum purchase volume for buyers, it removes the need for a small business to rely on large distributors and empowers them to experiment with new brands before the small business commits to buying a large quantity. Furthermore, if the marketplace can get to a size where it can negotiate pricing with brands, it can offer a wholesale price to small businesses at a price similar to what a big buyer might get.

2. Facilitating the transaction

This function solves pain point #2 related to the inefficiency around B2B payment. The marketplace can do all the heavy lifting for small buyers, such as confirming the availability of the goods in stock and sending the invoice. By automating many of the steps in the transaction process, the marketplace can help small businesses to free up time to focus on other parts of the business.

3. Supporting the fulfillment of the orders

This function solves pain point #3 related to communication. The marketplace can facilitate the communication between buyers and sellers. It can integrate with shipping companies like FedEx to help small businesses to stay up to date on the shipment status. It can also enforce rules to ensure that price increase can be properly communicated in advance and incentivize good behaviors for both buyers and sellers.

4. Providing value-added services

CPG wholesale marketplaces also have the opportunity to leverage their large amount of data to provide actionable insights to both the sellers and small retailers (e.g. what products are trending).

Current players

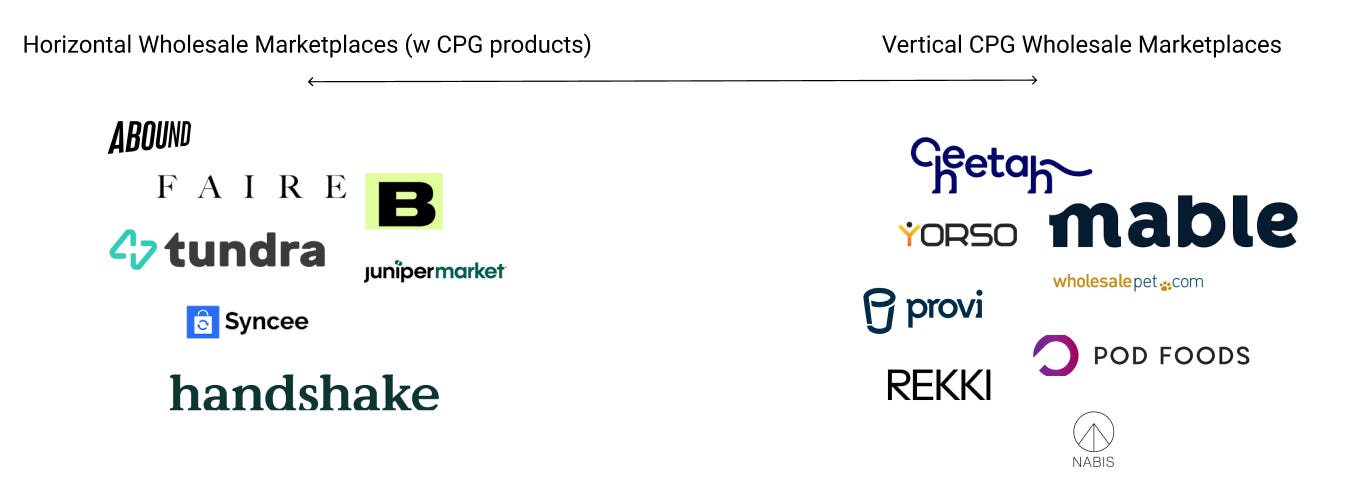

Many new startups have emerged in this space. Currently, there are two types of players:

Horizontal platforms that carry CPG products

Vertical marketplaces that focus on specific CPG categories

Horizontal wholesale marketplaces:

CPG is not a focus of these platforms but it does have a presence on their sites. Most of them focus on fashion, jewelry, and home products and have a CPG section like food and beverage.

Some companies in the space:

1. Faire - 300K+ retailers & 40K+ brands and has raised $1B+

2. Abound - 400K+ products and has raised $60M+

3. Tundra - 25K+ retailers and has raised $38M+

4. Handshake - 65K+ retailers and was recently acquired by Shopify

5. Bulletin - focuses on top brands and has raised $9M+

6. Syncee - focuses on drop-shippers

7. JuniperMarket - incubated by International Market Centers

Vertical CPG marketplaces:

Most of these vertical platforms focus on either a CPG category or a specific buyer profile (e.g. restaurant).

Some companies in the space:

1. Cheetah - focuses on restaurant and has raised $65M+

2. Nabis - focuses on the cannabis market and has raised $40M+

3. Mable - connects emerging CPG brands with specialty grocers and has raised $9M+

4. Yorso - focuses on the seafood market

5. Provi - largest B2B beverage marketplace and has raised $125M, currently serving 10% of the bars and restaurants in the US

6. Rekki - focuses on the restaurant industry and mobile ordering

7. Pod Foods - focuses on grocery stores and has raised $13M+

8. Wholesalepets.com - pet products wholesale and has been around since 2001

The future of CPG wholesale marketplaces

There are several trends I have heard after chatting with investors and customers in the space. Here is a couple of them:

1. Rise of highly verticalized marketplaces

More and more new wholesale marketplaces will be verticalized. One size doesn’t fit all. Even within the CPG industry, there are many different verticals, which require vertical-specific workflows and monetization models.

The key to success in this industry is to focus on a specific category (e.g. beverages) - identify power users in the beginning and slowly expand the product and category offerings to meet the needs of power users.

2. Rise of premium services

Another trend is that wholesale marketplace startups are offering premium services to both sides of the market to create additional ways to monetize.

In fact, many marketplaces are removing transactional fees altogether. They monetize indirectly by selling ads/data, creating a lending product, and negotiating volume discounts from suppliers. For example, Tundra doesn’t charge any commission fee on transactions, and instead, they make money through selling promotional opportunities on a cost-per-click basis, similar to Google Ads.

It is very hard to justify a high take rate, especially in the CPG industry where the margin is already slim.

✨ Bonus content

Okay… let’s do something fun. I am going to talk about what I would do if I were to start a wholesale marketplace startup tomorrow. This is completely made up and it is most likely a terrible idea.

First, I would decide which CPG category to focus on as my initial wedge. In my case, I would go with Asian snacks & beverages. I have an unfair advantage due to my knowledge of different products in the space as a long-term consumer and my ability to communicate with Asian suppliers, specifically Chinese. I also know it’s a growing market in the US with many startups raising money - though mostly in the B2C space (e.g. Chowbus, Weee!, etc).

Second, I would try to focus on cracking one side of the equation first - the supply side. The supply side is more financially motivated since it doesn’t really take them that much time to set up a profile. I would reach out to all the snacks and beverages brands that I know will be popular and distributors that carry those brands and try to curate the initial few hundred SKUs that I know would sell while mixing in some emerging brands that most ethnic grocery stores don’t usually carry. I would also only focus on California initially since it is closest to Asian suppliers and has the densest network of Asians.

After curating the initial best suppliers. I would go out to find demand to get the initial suppliers excited about the platform. Once the demand starts to ramp up and show some initial traction, I would then slowly scale supply and demand in parallel. In the meantime, I would experiment with different monetization methods. I might start with charging a small transactional fee while also experimenting with other methods like selling ads and data, offering premium services, etc.

Once I validated the unit economics, I would then expand to different major hubs like Chicago, New York, Houston. Over time, I would also expand the verticals to cover meat, pantry, and all the needs of the power buyers (assuming they are small specialty grocers).

I wanted to give a special shout-out to my friend David OIa (investor at Point Nine), who gave me a ton of insights into this wholesale space.

By the way, make sure to share it with your investor or founder friends who might be interested in the space. It would mean a lot to me!!

See you soon 👋,

Leo

Great Article, Leo! Keep it up.