Hey hey 👋,

Welcome to the 316 founders and investors who have joined the Consumer Startups family since the last post! If you haven’t subscribed, join thousands of other consumer founders and investors by subscribing here:

Today’s Consumer Startups is brought to you by… Kandidate

Kandidate helps talent teams to hire fast.

A Kandidate sourcer will build deep pipelines of qualified and engaged talent, source 100+ candidates per role, and give your talent team 50-70% more time to focus on engaging, interviewing, and making offers.

Kandidate has helped companies like Airwallex, Zoomo, Miro, & 50+ scaleups hire better talent and eliminate unwanted agency fees.

They are now offering a 100% free 48-hour trial to work with one of their sourcers to fill your highest priority roles.

Today, over 41M Americans are participating in the Supplemental Nutrition Assistance Program (SNAP), also known as the food stamp program. SNAP helps families from low-income or no-income backgrounds to fulfill basic food needs. In the state I live in, California, 10% of the state population relies on food stamp benefits. This number reaches close to 17% in New Mexico and West Virginia.

These past few years have not been kind for many families, particularly those from low-income backgrounds. As inflation worsens and recession looms, many of those families are facing deteriorating financial conditions, struggling to pay rent and feed their families. According to a survey conducted by Propel, financial insecurity has been rising since this May. 47% of low-income households are running low on or without most things they needed at home. A significant level that’s not been seen since January 2021. Below are some more statistics on the gloomy reality of many low-income Americans today:

This is a quote from a low-income mom:

“It has been several times when I have gone to bed starving just so I could make sure my girls were good and full that night…It breaks me down when I hear my daughter say ‘but mommy, you really need to eat to keep your body nutrition’ " - Tierny, MI

As the tech world blossoms in the past decades, many positive externalities of innovations have not extended to low-income families, who are often overlooked by traditional tech companies. The irony is that those are often the people that need help the most. It is a problem that I deeply care about. Both of my parents grew up impoverished in rural China and there are people in my life that are still facing the stress and daily struggles that come with the lack of financial security.

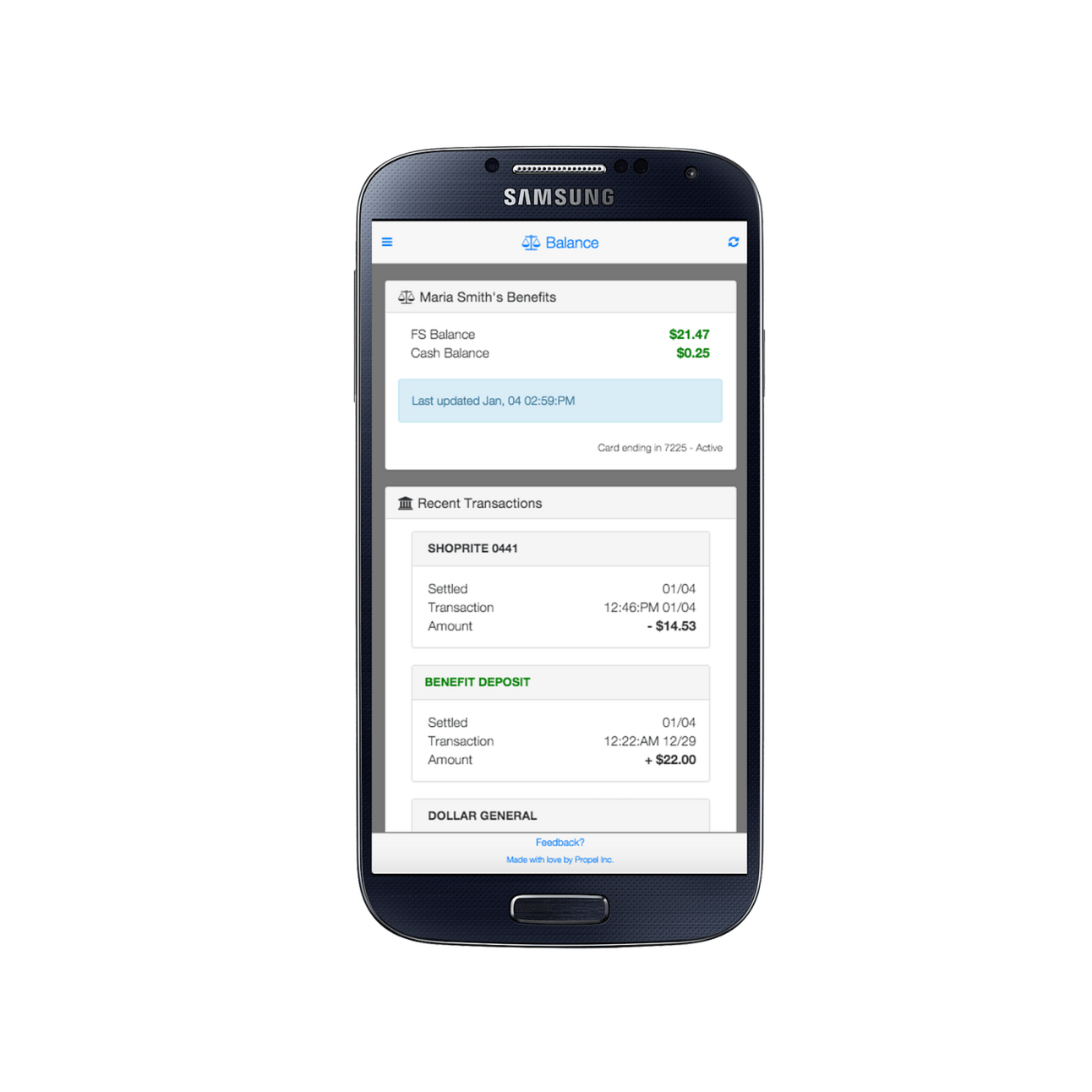

Propel is a startup that’s building fintech products to help this often-overlooked population improve their financial health. Their flagship mobile app product, Providers, makes it easy for users to manage government benefits (e.g. food stamps balance), save money, and find jobs to earn money and advance. Founded in 2014, Propel is used by over 5 million Americans in 50 states, or one-fourth of the families that rely on SNAP benefits.

I had a great time chatting with Propel’s COO, Jeff Kaiser, about the journey of Propel. One theme you will notice later is the scrappiness of the founding team and the deep empathy they have for their users - these two are the main secret sauce that propelled their massive success today.

Genesis

Propel is founded in 2014 by a Stanford alum, Jimmy Chen, who experienced the food security problem first-hand growing up in a low-income household. After working as a product manager at LinkedIn and Facebook for a few years, Jimmy decided to launch his own startup to help tens of millions of low-income American families.

He launched the startup through Significance Lab (now rebranded as Blue Ridge Labs at Robin Hood Foundation), a program that focused on taking people from traditional technology backgrounds and exposing them to the problems faced by low-income American families.

Coming out of the program, the biggest problem Jimmy wanted to solve is the benefits access problem, with the goal of making it easy for low-income families to apply for SNAP.

“I learned about the challenges of poverty and quickly prototyped solutions to the problem. The singular experience that stood out was the experience of using food stamps in Brooklyn. I saw hundreds of people waiting to see social workers. At this moment, I realized that social services lagged far behind times of what software is capable of, and thereby Propel was born!”

- Jimmy mentioned in an interview with Social Good of Silicon Valley

The SNAP application process differs based on which state you are from. Usually, you have to fill out pages of paperwork or apply online, provide the required documents to prove your identity and income level, and then wait to hear back from the government to see if you qualify and how much you qualify. Once you are approved, you will receive a debit card known as the Electronic Benefits Transfer(EBT) card, which will reload with the approved balance each month to spend in grocery stores.

Two main issues with the application process were

Application process was not intuitive and unnecessarily complicated

Online application didn’t work well on mobile

He launched the MVP, a mobile-friendly website called easyfoodstamps.com, to make it easier for low-income families to apply on their phones and get money from SNAP. It was particularly important to address the mobile issue because when it launched in 2014, 50% of workers with $30K or less annual income had a smartphone and 20% of them were smartphone dependent since they didn’t have internet access at home. Both numbers are significantly higher today.

MVP & First Pivot

Around that time, now cofounders Ram Mehta and Jeff Kaiser joined Jimmy to work on the initial product easyfoodstamps.com, with a focus on improving the tech and finding a business model.

They first launched in Pennsylvania with the initial hypothesis that they could make money from grocery stores by signing up their customers for food stamps benefits. It seemed like a win-win-win situation:

Grocery stores could benefit from additional spending power from their regular customers, who might have been eligible for food stamps but never applied for them

Customers could benefit from gaining access to food stamps they are eligible for

Easyfoodstamps.com can make money from grocery stores

To validate this hypothesis, they went to North Philly and started chatting with customers at different grocery stores in low-income neighborhoods, with the main goal of signing them up for SNAP. After pitching to 100s of customers in a span of a few months, they quickly faced two massive hurdles:

Logistics problem: The front-end website was easy to navigate but the back-end logistics were a nightmare. They were converting the inputs from that web form into PDF and then submitting it via fax to the state government because that was the easiest way to integrate into the government's existing workflows without integrating with the government’s backend.

Demand problem: Many people they were pitching to had already signed up for SNAP and they were just going to grocery stores to use their EBT cards

However, those initial conversations were not wasted. Even though the product didn’t pick up traction, they quickly realized that the bigger pain point for those families was the experience of figuring out how much money was left on their EBT cards.

Time after time, they were noticing that families would go into the store and take out a fistful of crumpled grocery receipts from their pockets to see how much money was left from their last transaction or ask the cashier to swipe the card to let them know the balance. Those are all moments of friction for someone that uses a SNAP/EBT card and these moments make them stand out in a grocery store.

“The last thing that a mom with her kids in the grocery line wants to do is to slow things down or to cause a scene at the grocery store. What we heard from people was that the worst possible experience, the thing that you're going so far out of your way to avoid, is the experience of swiping your card and being told that you don't have enough money left on it, and you have to put some of those groceries back. People were willing to go through a lot of hassle to avoid it.” - Jeff said

These observations led them to refocus their effort on helping low-income families to better manage their EBT balance. In late 2015, they launched their second product EasyEBTBalance to do just that.

Product scaling

The idea for EasyEBTBalance was to create a simple interface that allows people to check their EBT balance and transactions easily, no matter which state they live in.

First 10 customers

They went back to the same grocery stores in North Philly and started pitching their second idea. At the time, they didn’t have the app live on either the Play Store or App Store yet so they just handed people a demo phone for them to sign up to see their EBT balance.

The first moment the team realized they were on to something was when they saw people were excited to see their balance in real-time without the need to scan their card at the cashier or call the 1800 number on the back of their EBT card.

They acquired their first 10 customers by pitching in person with a demo phone.

First 100 customers

Fast forward to January 2016, they launched the app on Google Play Store in both Pennsylvania and New York. To get the initial adoption going, they went to the food stamps office in New York which was part of the Human Resources Administration (HRA). It was the perfect location to pitch the product because most people that visited the office already had benefits and were there to recertify or make changes to their benefits.

They started pitching to people as they were coming out of the HRA building and onboarding them to the app on the spot. It was an amazing experience not only because it helped them get the traction they needed but also because they were able to observe people’s behavior using the app in person and see what they needed to improve. For example, they noticed people had security concerns because they were sharing sensitive information via a smartphone app. These observations led them to change their messaging and several product features.

They acquired their first 100 customers in person at places where they were most likely to find a high density of their target users.

First 400K users

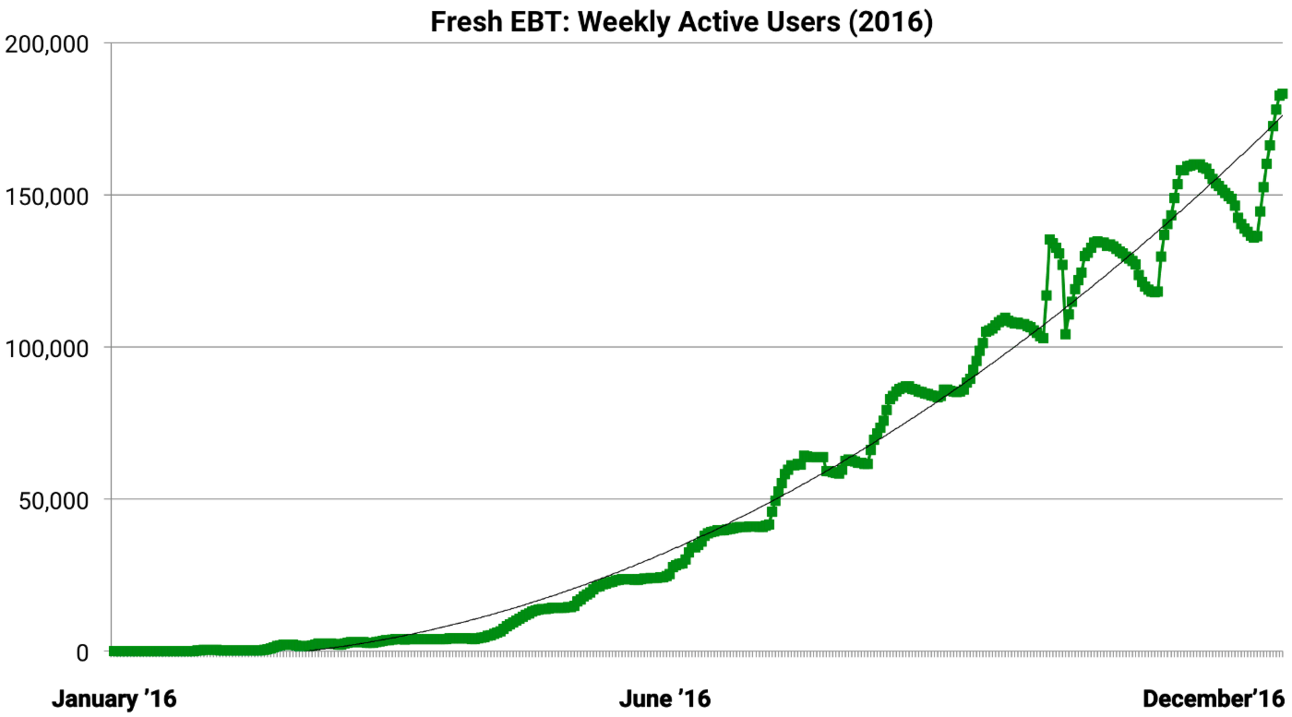

In 2016, they rebranded the app to Fresh EBT. It was also the year when their growth exploded. By the end of the year, nearly 400K people had downloaded the app. They didn’t do any advertising early on because they wanted to focus on expanding the app to all 50 states. They wanted to go to market with the idea that ‘this app is for everybody with an EBT card in any of the 50 states.’

Word-of-mouth growth was the main growth engine.

“We had Google Analytics installed and we would just sit in the office and pull up Google Analytics every morning to see if anybody was using the app in real-time. At that point, we had built relationships with our customers and we would call them up and ask ‘hey, have you told anybody about this app? And we heard from a lot of people that they had been sharing it with their friends and family.” - Jeff said

They acquired their first 400K users by building a delightful product that solves a real pain point, and ensuring everyone who needs the app can use it, no matter where they are in the country.

Propel Today

Since 2016, Propel has gone through many iterations and relaunched the product as the Providers app. Not only can you check your EBT balance, but you can also use the app to find coupons to save money and find relevant jobs to make additional bucks to get through the month. Propel also launched a banking product in 2021–the Providers Card–offering a great alternative to traditional banks for low-income families who face disproportionately high fees for basic financial services.

It’s making a difference to millions of low-income American families. According to the team, “Propel’s user base has grown by more than 2 million households over the past two years. While checking their balance, a Providers user might see updated information about the Child Tax Credit (3 million people in 2021), apply for a job (300,000 people in 2021), or open up a no-hidden-fee Providers debit card (millions registered after the launch in summer 2021).”

Earlier this year it also raised a $50M series B led by Nyca Partners, with participation from existing investors Andreessen Horowitz, Kleiner Perkins, and Flourish Ventures.

I have a feeling that Propel is just getting started.

That’s it for this week! See you all soon 👋,

Leo